The undulations of 2022 saw a hardening of the global insurance market. As we cast our gaze to the year that lies ahead of us, more than ever, will it be crucial for companies and organisations to adopt insurance proactivity, as the ever-expanding market landscape is set to deliver further hardening throughout 2023.

Hunter Broking Group is proud to deliver our 2023 market update. Understanding the factors influencing the hardened insurance market is the best way to work with the tide rather than swimming against it in today’s ultra competitive conditions. We detail how your firm can make proactive headway to ensure you hold the best chance of accessing coverage.

INSURANCE MARKET IN REVIEW

For all participants within the insurance industry, it can be agreed that 2022 delivered a particularly complex year — in fact, the costliest year of natural disaster losses in Australia.

The continuing of the COVID-19 pandemic is not wholly to blame for a hard insurance market. Amongst the long list of contributors, the manifestation of the climate crisis certainly left its mark on our country through a rise in extreme weather events. It only takes a look back on the flooding disasters throughout Australia over the past 12 months to appreciate the devastation that severe weather has caused to communities, buildings and infrastructure. Compounding the increasing prevalence of extreme weather events was significant individual fire losses experienced throughout 2021 and 2022.

As sustainability embeds itself as one of the pivotal principles of modern times, environmental accountability pressures cascade into the insurance industry. So too, does class action activity, as it increases litigation for c-suites across the globe. Within our own shores, there has been additional regulatory scrutiny on directors and boards and an influx of cyber-related crime.

Global markets have also been seriously impacted by the war in Ukraine, with insurance remaining no exception. The flow on impacts of COVID combined with the disruption of global conflict has inflated the supply chain issues and costs in many industries, notably the construction sector.

Finally, inflation’s impact on insurers resulted in higher costs from the treaty reinsurance market, pricing challenges and lower investment returns. Inflation, while it has a lot to answer for, is easing in the USA, however it’s the rate of change of inflation which is causing increased uncertainty of the future

cost of capital.

If you’ve experienced a rise in premiums, faced difficulty in sourcing new policies or challenges in reviewing existing policies, you’re not alone. Increased premiums and a reduced appetite for risk are some of the fundamental characteristics of a hardening insurance market and a natural response to the cause-and-effect relationship of what is largely an unprecedented confluence of factors affecting the global insurance ecosystem.

COMMERCIAL INSURANCE IMPLICATIONS

It may go without saying that more losses experienced at the hands of extreme weather events and greater disruption to businesses caused by cyber events make more significant implications across all areas of commercial insurance.

For policyowners, premium rises are an unmistakable sign of the times. High premiums are more than insurers trying to increase profits to shareholders. Higher than average claims, in conjunction with premium ratios diminishing at the hands of investment returns means that insurers are left with little option but to increase premiums in order to continue offering coverage. Reinsurance continues

to become more costly, as there simply isn’t any further availability for investors.

As an example, APRA recorded that in the year leading to September 2022, there was an 8.1% rise in gross claims expenses, totalling $46.3 billion. To put matters into perspective, the global average cost of a data breach in 2022 (excluding any ransom cost) was almost $6.3 million.

THE INSURER RESPONSE

Amid some of the most challenging insurance conditions experienced, it’s little wonder why insurers are reducing their capacity to offer cover to the scope and scale previously accessible to companies, corporations and conglomerates. Extraordinary claims and over-inflated asset values, combined with low returns on investment, have caused a severe dent in insurers’ underwriting profits.

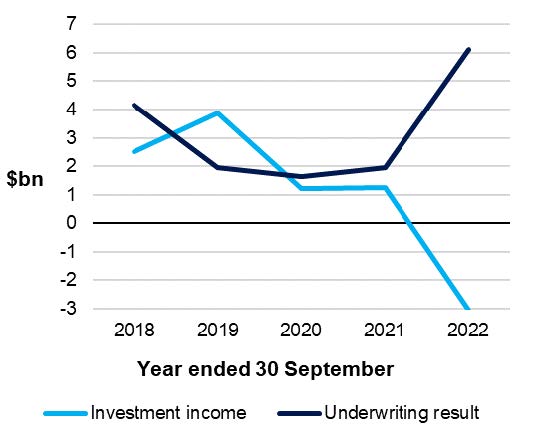

The proof is in the numbers: in the year leading to September 2022, there was an annual change in

underwriting result of 215.3%, whereas the investment income returned negative $ 3 billion.

Major Profit Components

Source: APRA

The cost and availability of construction materials has also seriously impacted claims costs. In total, the east coast flooding disasters experienced $6 billion in losses and the bushfires totalling $2.3 billion in losses3. A case in 2022 showcased the exacerbated claims and rectification costs: a business owner insured for $2 million for the past eight years faced a rebuilding cost of almost $8 million after Australia’s east coast flooding disaster destroyed his commercial property. A natural consequence of delays in

rectification of businesses is that there is then an increase in business interruption losses also.

Business owners needn’t feel despondent. The implications of the hardened market on commercial insurance provides business owners with the opportunity to reassess business and asset values, examine cash flow efficiencies, and implement practices and policies to solidify their operations and help protect their commercial viability in years to come.

In light of combined ratios and reinsurance costs soaring while return on equity plummets, reduced capacity of insurers often comes by way of portfolio remediation. Shoring up risk selection and underwriting guidelines is standard practice for insurers in the midst of a hard market, until they are able to recuperate underwriting profits and provide ample return to shareholders.

It’s important to remember that insurance, like most things, works in cyclical markets. The actions taken by insurers is necessary to secure their operations and ability to continue providing cover in future years. Adapting to changing market conditions is certainly not a new practice for insurers and businesses alike. Understanding the objective of insurers and the factors that are influencing their ability to provide coverage can be the key to working with them, rather than battling against them, to find a solution for your firm.

Source

- https://www.apra.gov.au/sites/default/files/2022-11/Quarterly%20general%20insurance%20performance%20statistics%20highlights%20September%202022.pdf

- https://www.apra.gov.au/sites/default/files/2022-11/Quarterly%20general%20insurance%20performance%20statistics%20highlights%20September%202022.pdf

THE HEIGHTENED IMPORTANCE OF PROPERTY RISK EVALUATION SURVEYS

For many industries, property insurance comprises a large portion of their commercial insurance needs. The tightening of the insurer belt often means that property surveys are not optional, but compulsory before policies are able to be renewed. With the present nature of the industry, insurance risk surveyors are in high demand. Renewals may be expected to be received 4 – 6 weeks from your renewal date, however, at Hunter Broking Group, we’re witnessing a lag in the availability of risk surveyors. Without a property survey report to present to insurers, policyholders face the very real risk of having a renewal

lapse, or be declined for further cover.

More than ever is it critical for underwriters to understand the property and business interruption exposure that exists. Inflation has a lot to answer for, with property and assets rapidly increasing in both repair and replacement value. Conversely, insurer’s capital returns decline in high inflation environments, exacerbating the gap. Business income and supply chain delays, as well as a labour shortages also mean that claims have been extenuating past the adequacy of the coverage limits.

Furthermore, the sharp rise in the cost of materials, labour shortages and supply chain disruptions on top of highly inflated property and equipment values mean that without quantity surveyors, the true asset replacement cost is often seriously underestimated by business owners and policyholders. The current market is such that without a building or quantity surveyor report, your efforts to sourcing new cover or having an offer of renewal can be in vain. We strongly advocate for clients to use quantity surveyors and building surveyors to gain a better understanding of their true asset replacement cost.

Inadequate data can mean inadequate cover. Additionally, poor data quality affects the willingness of insurer’s to provide coverage. Property risk evaluation and quantity surveys provide a thorough and accurate profile of the property and business to be insured as well as provide transparency to the insurer on the risk management framework that exists to help mitigate loss.

CYBER COVER RISK MANAGEMENT EXPECTATIONS

Similar to the precondition of property risk evaluations for new or renewal cover offerings, insurers are responding to the hardened insurance market and increased prevalence of cyberattack losses by increasingly requesting evidence of a firm’s risk management culture and cyber hygiene. This can include a detailed examination of your organizations’ IT security spend, type and volume of data held, cyber strategy and governance arrangements.

Many cyber insurers want to assess how information assets are protected through security controls and the reliance on shadow IT. Working with IT organisations is not only one of the best strategies to build a formidable cyber risk management framework, but they can help firms access superior anti-virus software, implement robust IT infrastructure such as firewalls and guide business policies and procedures such as implementing mandatory password changes and using encrypted password managers.

An insurer’s risk management expectations can also extend to investigating any third party arrangements, testing regimes, any prior data breaches and testing regimes. It is not uncommon for insurers to make regular tabletop scenarios where a condition of coverage includes the participation of senior management.

The cyber insurance market is rapidly evolving — in a bid to meet the ever increasing demands of data privacy regulations, cyber insurers need to respond accordingly. At Hunter Broking group, we anticipate that within the next two years, mandates will be introduced by insurers for organisations to use Multi-Factor-Authentication (MFA) before cyber insurance coverage is offered.

PREPARING FOR THE UNDERWRITING PROCESS WITH CYBERSECURITY CONTROLS

One of the big-four banks recently stated that it prevents around 50 million attacks on their digital channels each month — this kind of mitigation simply wouldn’t be achievable without implementing and continually evolving the best cyber security controls. In preparation for the underwriting process, some of the top cybersecurity controls that your business can look to implement, or review, are:

« Multi-factor authentication for remote access and administrative (or privileged) controls or Privileged Access Management (PAM)

« Secured, encrypted and tested backups

« Endpoint Detection and Response (EDR)

« Remote Desktop Protocol (RDP) mitigation

« Web security and email filtering

« Patch management and vulnerability management

« Cybersecurity awareness training and phishing testing as well as cyber incident response planning and testing

« Vendor/digital supply chain risk management

« Logging and monitoring and network protections

Cyber risk improvement remains an incredibly prominent facet of commercial insurance, as it goes hand in hand with cyber insurance. Investing in Information Technology and cyber security improvement not only helps protect your business, but will be required for your business to access protection.

THE EFFECTS ON REINSURANCE

There is no better example of the drastic impact on reinsurers, than when you consider that 50% of Australian natural disaster losses have actually been reinsurance losses. Due to the return on investment being eroded by the exacerbated claims costs and undulated investment markets of 2022, there simply

isn’t any investor interest in reinsurance, which makes reinsurance far more difficult to obtain.

Reinsurance cost allocations are assigned to individual risks and based on multiple locations, such as the structure type, perils exposure and location. This layering effect is also what’s causing difficulty and increased cost in the reinsurance market. For example, bushfires (which are now a global focal point

in insurance), and floods are loaded into the initial reinsurance layers due to their frequency and severity, whereas earthquakes and cyclones have a lower likelihood of occurring, but are much higher impact. In the USA, hurricane Ian is on track to become the US’s largest insurable loss, in history.

WHY SERVICE MATTERS

For c-suites, boards and business owners, our critical message is around forward planning and necessary

proactivity towards commercial insurance. Rather than relying on ‘renewal reactivity’, without forward planning and prior preparation, large scale corporations are being left uninsured, as risk tolerance of the world’s major insurers decreases, increasing competition for policies.

The selectivity and scrupulousness of insures in the present climate is such that, without a comprehensive

and convincing presentation of companies to the insurer, major global firms can (and are) left uninsured. The benefits of accessing commercial insurance brokers are not lost on prudent Australian business owners. However, there is a marked difference in transactional brokers and those that form a relationship to understand your firm at a granular level.

Hunter Broking Group prides ourselves on our relationship-centric approach to commercial insurance.

With the evolution of the insurance ecosystem and the market hardening, no longer is price-hunting the favoured strategy to solve insurance price hikes.

Price chasing runs the risk of jeopardizing both your cover and service. By intimately understanding your business, we best position ourselves to work with you from a strategy perspective instead of merely facilitating the delivery of a renewal notice.

Our market guidance is to expect increases, but focus on mitigation, which takes more than shopping around for attractive quotes.

Don’t be kept in the dark when it comes to approaching your commercial insurance strategy — understand more about how we use proactivity and preparation to present your business in the best light by reaching out to [email protected].